Here I will try to compare total value of chia network by calculating the value of the equipment used to maintain the network.

Chia Network

At the moment, on this day chia network size is 31EiB, that is 35,740,566TB of HDD space. For the purpose of calculating value, let us say that all the HDD’s are 10TB WD. I know that they are not :), but let this be our approximation for the purpose of calculating approximate value of netspace.

10TB WD HDD price is 300 USD (source: https://www.westerndigital.com/en-ie/c/all-products ), that makes the price of a HDD that size around 30 USD/TB, I know that someone would say that you can buy disk at a lower price, but I a certain that those low price disks are either used ones, or not from the vendor. Their quality can be doubted.

31.000.000TB in all brand new 10TB WD HDD’s can cost around 35,740,566TB x 30 USD/TB equals 1,072,216,980 USD in only HDD’s.

One must keep in mind that computers are not entirely made just of HDD’s, but the price of other components was not in the calculation, for simplicity purposes.

Total market cap for XCH at this moment is 228.000.000 USD (source: https://crypto.com/price/chia-network)

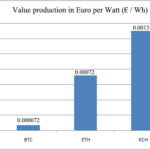

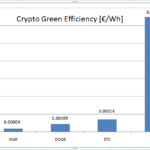

If we divide market cap with equipment value, this is what we get:

228.000.000.USD / 1,072,216,980 = 0.213

Ethereum Network

At this moment in time, all ethereum network hashrate is 971TH/s (source: https://2miners.com/eth-network-hashrate).

Let say, for the sake of mathematics, that all the GPU’s on the ethereum network are Geforce RTX 3070. An average price for RTX 3070 is 1,600 USD (source: https://www.amazon.com/stores/GeForce/RTX3070_GEFORCERTX30SERIES/page/127E4131-DA71-49E3-902E-C382ABEC4AC3). An average hashrate for RTX 3070 is 60MH/s (source: https://2cryptocalc.com/gpu/24h/3070/1).

971,000,000MH/s / 60MH/s = 16,183,333 RTX 3070.

16,183,333 x 1,600USD = 25,893,333,333 USD is the value of all GPU’s committed into ethereum mining.

Total market cap for ETH at this moment is 301,100,000,000 USD (source: https://crypto.com/price/ethereum).

If we divide market cap with equipment value, this is what we get:

301,100,000,000 / 25,893,333,333 = 11.628

Now the math here is saying that ethereum network market cap is 11.628 times bigger than the approximately calculated value of the GPU’s mining for ether, as on the other hand chia network market cap is 0.213 times bigger, or shall we say 4.69 (1/0.213 = 4.69) smaller, than the price of all HDD’s needed to support the network. This means that at this point, just the HDD’s holding all the plots for housing the chia network are 4.69 times more expensive than all the XCH on the market.

People with bad intentions could say that this means the Chia is on its way to leave the crypto market, and that it will never recover from this drop, but I beg too defer, and here I will try explain why.

First of all, everyone has to keep in mind that the Chia coin (XCH) went on the market in May 2021, today is January 2022, we are only 8 months in the XCH existence, and that is an infant coin at least.

Ethereum on the other hand, exist since 2015, that means for 6 years now. 6 years is an eternity in the world of crypto, and it has traveled the way from a cheap token to an expensive currency that is by some standards even better than Bitcoin. His price started trading at 0.7 USD in 2015, his price now is 2,200 USD (source: https://coinmarketcap.com/currencies/ethereum/).

Here is the ETH graph from the beginning

People easy forget that 2015 was pretty long time ago, this was a time when a lot less people were interested in crypto than today, the “crypto community” was much smaller in scale compared with the one today, and it took time for the coin to get the momentum.

This is how he looked from 2018 to 2020

One could say that the graph is much like the one for Chia at this moment

Year 2021 was the year with exponentially higher “crypto community” and the demand for crypto currencies.

When Chia Network emerged in 2021, the community brought a lot of hype on to the coin, so it gained by my opinion to much momentum, in a way that is skipped Ethereum’s 2015, 2016 and 2017. Also there are much more people investing in cryptocurrencies, and the hype raised around Chia in may was just over the top.

Regardless of that, I think XCH is here to stay, and we are looking at the new revolution, the next leap in the world of crypto!

Article by:

Radovan Georgijevic,

MSc science, PhD student

University of Belgrade,

Faculty of physical chemistry.

You are free to use the content of this article, and its statements as long as you refer to it via URL, otherwise I will consider that you are infringing my copyright!

Dylan G

January 25, 2022 at 2:44 pmI think price per terabyte should be estimated at $20 as $30 is more than most farmers would pay. The size of the netspace is measured not in terabytes but in tebibytes. If you want to estimate costs, please be aware that a 10 terabyte drive does not yield 10 tebibytes of space when plotted. Please revise to be as conservative as possible and imagine that drives used to farm are purchased as cheap as possible and that plotted space is as high as technically feasible for said drives.

John B

February 19, 2022 at 4:49 pmI agree with Dylan. WD 14TB USB drives are available for around $240 on Amazon and Newegg.

I have been targeting <$2 per K.32 plot. I know there are all sorts of rigs with <$10/TB but you have to get lucky with the connecting hardware. Chia published a piece on 'reference hardware' using the Open Compute platform, but that ends up around $3/plot (K.32). Under $200, XCH is not economically viable. When the halving occurs it will be worse unless HDD prices drop accordingly. The viability will be exhibited in the netspace growth. If there is no growth then enough people have done the arithmetic.