Bitcoin has about 15.000 unique nodes, Ethereum 5.500, and Chia 350.000. You can check this information on bitnodes, ethernodes and the official web of Chia, where it says “Chia is the most decentralized blockchain ever with approximately 350,000 nodes”

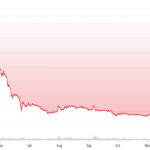

As an extension of your valid point, it’s hard to say how much the price drop is underrating vs how much it was wrongly overvalued at its launch on the perfect timing for a crypto moon across the industry.

Having started plotting since a few days before mainnet launch, I clearly recall the pre-launch post sentiment here: people saying I’ll buy an xch for $20, others replying no way it’s probably worth 50 or 100 right away. Then mainnet launched and the price rocketed to sit at a base of 600 while testing waters at 1000, 1300, 1600 before the whole crypto space crashed. (I sold only 0.5xch at 1300)

In hindsight, it looks like that 1000-1600 valuation was purely because no one knew how quickly chia would have real profitable uses or how many investors would hold confirmed interest–because netspace was exploding (remember all the jokers who said 100-200EB in 3 months? I was there, telling people to calm down and 30-50EB was the realistic area it would stop being exponential). An exploding netspace gave foolish short term speculators false confidence that it’s the next bitcoin for sure.

So when the crash happened and the short-term people dumped for stop-loss, even the rest of the community was faltering and shaken. People saw $100/day profit projection turn to $10/day within weeks and concluded coin’s dead. But the whole problem is chia was not supposed to be worth over $1000 at launch, it was indeed supposed to be worth more like $100.

To sum it up, after so many months of gradually adding features and proving with the sizeable 30+EB netspace that it’s not dead, yes chia is now undervalued. If it had launched at $100, it shouldn’t still be worth $100 after proving so many positive things about how it has been working and getting “miner support”.

What’s wrong is that it started too high and a bunch of short-sighted traders moving huge money around for daily profit are refusing to touch chia for the rest of 2021 after so many of them got burned the first time. And thus you are right to assume that once there are real “spenders” of chia using them for other applications and industries, these jokers will come back and pump the coin back up.

So chia’s current price is completely irrelevant, it’s in something like a wave antiphase now (yes, like the physics waves). Once the China crypto crackdowns subside, US interest rate announcement stabilizes, next bitcoin/eth to the moon, etc. and chia proves its first major corporate client usage subsequently, it’s almost impossible to estimate how much the price would increase by. Just $50? $500? $1000?

The reason people say the coin is still risky is just because there’s no guarantee yet that external 3rd party corporations would commit and use the xch system to do defi in a sea of alternatives. Apart from that, netspace and coin price should be directly proportional, which means the coin at 34EB could have been speculated reasonably in the $400-1200 range if not for a minigun barrage of unfavourable international conditions that made traders avoid xch like hydrophobic coating and water, until it proves itself not a cursed coin.

Decentralized Cryptocurrency

[…] Now, why can we expect great price growth of the Chia Coin? […]